Indian equity indices went through a turbulent week as they failed to negotiate a close above the neutral line for even a single session and eventually snapped the week with a cut of over two percent.

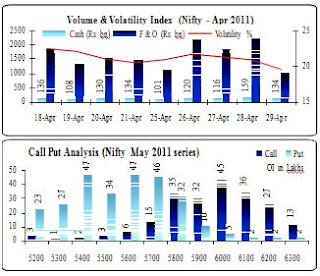

The week largely remained characterized by choppiness because investors were reluctant to pile up positions and indulged largely in stock specific activities as corporate India continued to divulge their fourth quarterly report card. Volatility gradually accelerated session after session as the April series Futures and Options settlement neared while quarterly earnings'announcements by RIL, Wipro, Bank of Baroda, Ambuja Cement, Crompton Greaves, TVS Motors were punished badly as they remained below Street's expectations. On one hand spiraling international crude oil prices become the headache of policymakers while on the other, worries over global economic recovery loomed large, given the fact that world's biggest economy continues to grow at a tepid pace. The April series F&O settlement day turned out to be another pathetic trading session for the Indian stock markets as the selling pressure gathered greater momentum after government released the disappointing food inflation numbers which stayed absolutely flat at 8.76% on annual basis during week-ended April 16 compared with 8.74% recorded in the previous week. Rate sensitive counters like Real Estate and Bankex witnessed relentless selling pressure througsession for theh the week ahead of the RBI's annual monetary policy review meet on May 3rd where it is expected to bite the bullet and hike rates by 50 bps to cool the spiraling inflation which has vehemently hovered at uncomfortable levels on the back of crude oil prices which have skyrocketed by over 50% in last six months. The Foreign Institutional Investors on the other hand ploughed back their money from the local markets to the extent of Rs 2,703 crore in the week on expectations that deteriorating domestic macro headwinds will have adverse impacts on the companies' earnings thereby reducing the returns on investment.

The Foreign Institutional Investors on the other hand ploughed back their money from the local markets to the extent of Rs 2,703 crore in the week on expectations that deteriorating domestic macro headwinds will have adverse impacts on the companies' earnings thereby reducing the returns on investment.

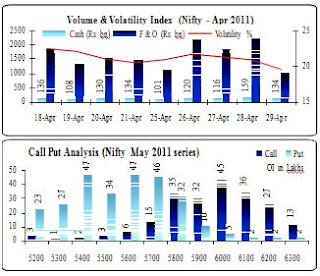

The Bombay Stock Exchange (BSE) Sensex lost 466.27 points or 2.38% to 19,135.96 during the week ended April 29, 2011. The BSE Mid-cap index declined by 141.07 points or 1.95% to 7,094.23 and the Small-cap index shed 163.26 points or 1.84% to 8,715.31. On the sectoral front, Reality lost 201.17 points or 8.45% to 2180.10, Capital Goods (CG) shed 607.16 points or 4.45% to 13,036.91, Bankex declined by 468.163 points or 3.46% to 13545.13, Oil & Gas tumbled by 301 points or 2.92% to 10,008.27 and Metal index down by 467.98 points or 2.81% to 16,190.59,were the top losers on the BSE, while Health Care(HC) adding 74.77 points or 1.21% to 6232.55 and FMCG advanced 24.78 points or 0.66% to 3755.16 were the only gainers on the sectoral space. The S&P CNX Nifty trimmed 135.20 points or 2.30% to 5750. On the National Stock Exchange (NSE), Bank Nifty lost 3.46% to 11,483.75, CNX mid-cap shed 1.36% to 8,200.95, CNX Nifty Junior declined by 1.35% to 11,376.70 and CNX IT tumbled by 0.92% to 6718.35. Conclusively we expect slightly range bound scenario between 5555-5960 though sentiments remain subdued for the upcoming sessions. Any closing above this 5960 with substantial volumes for at least 2 consecutive days may generate another 2-3% return and we might see 6070-6080 in the short term. HAPPY TRADING......

The week largely remained characterized by choppiness because investors were reluctant to pile up positions and indulged largely in stock specific activities as corporate India continued to divulge their fourth quarterly report card. Volatility gradually accelerated session after session as the April series Futures and Options settlement neared while quarterly earnings'announcements by RIL, Wipro, Bank of Baroda, Ambuja Cement, Crompton Greaves, TVS Motors were punished badly as they remained below Street's expectations. On one hand spiraling international crude oil prices become the headache of policymakers while on the other, worries over global economic recovery loomed large, given the fact that world's biggest economy continues to grow at a tepid pace. The April series F&O settlement day turned out to be another pathetic trading session for the Indian stock markets as the selling pressure gathered greater momentum after government released the disappointing food inflation numbers which stayed absolutely flat at 8.76% on annual basis during week-ended April 16 compared with 8.74% recorded in the previous week. Rate sensitive counters like Real Estate and Bankex witnessed relentless selling pressure througsession for theh the week ahead of the RBI's annual monetary policy review meet on May 3rd where it is expected to bite the bullet and hike rates by 50 bps to cool the spiraling inflation which has vehemently hovered at uncomfortable levels on the back of crude oil prices which have skyrocketed by over 50% in last six months.

The Foreign Institutional Investors on the other hand ploughed back their money from the local markets to the extent of Rs 2,703 crore in the week on expectations that deteriorating domestic macro headwinds will have adverse impacts on the companies' earnings thereby reducing the returns on investment.

The Foreign Institutional Investors on the other hand ploughed back their money from the local markets to the extent of Rs 2,703 crore in the week on expectations that deteriorating domestic macro headwinds will have adverse impacts on the companies' earnings thereby reducing the returns on investment.The Bombay Stock Exchange (BSE) Sensex lost 466.27 points or 2.38% to 19,135.96 during the week ended April 29, 2011. The BSE Mid-cap index declined by 141.07 points or 1.95% to 7,094.23 and the Small-cap index shed 163.26 points or 1.84% to 8,715.31. On the sectoral front, Reality lost 201.17 points or 8.45% to 2180.10, Capital Goods (CG) shed 607.16 points or 4.45% to 13,036.91, Bankex declined by 468.163 points or 3.46% to 13545.13, Oil & Gas tumbled by 301 points or 2.92% to 10,008.27 and Metal index down by 467.98 points or 2.81% to 16,190.59,were the top losers on the BSE, while Health Care(HC) adding 74.77 points or 1.21% to 6232.55 and FMCG advanced 24.78 points or 0.66% to 3755.16 were the only gainers on the sectoral space. The S&P CNX Nifty trimmed 135.20 points or 2.30% to 5750. On the National Stock Exchange (NSE), Bank Nifty lost 3.46% to 11,483.75, CNX mid-cap shed 1.36% to 8,200.95, CNX Nifty Junior declined by 1.35% to 11,376.70 and CNX IT tumbled by 0.92% to 6718.35. Conclusively we expect slightly range bound scenario between 5555-5960 though sentiments remain subdued for the upcoming sessions. Any closing above this 5960 with substantial volumes for at least 2 consecutive days may generate another 2-3% return and we might see 6070-6080 in the short term. HAPPY TRADING......