However, Indian fuel price inflation accelerated to an eight-week high in mid-June and the government's recent move to hike dieseland other fuel prices is expected to put upward pressure on prices in coming weeks and push headline inflation towards double digits. Local sentiments also remained optimistic as FIIs have turned net buyers since Thursday, indicating that interest of foreign funds are not fading any time soon. Back on Dalal Street, the benchmark began the expiry session on an optimistic note and oscillated above the neutral line in a narrow range through most part of the session, lacking any kind of volatility which is typically evident on F&O settlement days. After registering losses in the two previous F&O series, the June series F&O showed a swashbuckling performance adding over four percent from the last series. The NSE's 50-share broadly followed index Nifty, settled close to a percent gains just below the crucial 5,650 support level while Bombay Stock Exchange's Sensitive Index, Sensex amassed over one hundred and fifty points to close below the failed to mirror the performance showcased by their larger peers and important psychological 18,850 level. However, the broader markets negotiated only moderate gains. The midcap index added 0.32% points while the smallcap index rose 0.57% point. On the sectoral front, it was the defensive - FMCG pocket which once again outperformed not only its sectoral peers but also the benchmarks and surged by close to 2%.For the upcoming series 5760-5770 could be the crucial resistance zone where we believe spot index may find some consolidation. Any closing above this level may boost the traders sentiment however 5900-5930 may be the next resistance zone. On the flip side 5500-5530 may provide some important cushions on downside. HAPPY TRADING…….

Showing posts with label Nifty. Show all posts

Showing posts with label Nifty. Show all posts

Monday, July 4, 2011

Monthly Magazine Report - From the desk of Research - By Mansukh

The June series Futures and Options contract settlement turned out to be an encouraging event for the Indian markets as bulls showed strong buying interests in majority of the blue chip stocks. Hefty short covering in the dying hours ahead of the series expiry further stoked the benchmarks to settle around the high point of the day. The resilient markets seldom shown any signs of capitulation in last six sessions, as they vivaciously rallied over 1,250 (Sensex) and 350 (Nifty) points during the period. Sentiments mained upbeat across the lobe as investors ontinued to capitalize on he positive momentum om the previous session fter the Greek government uccessfully voted in favor fstringent austerity easures. A second vote for he implementation of the measures is expected in Greece later in the day. Majority of the Asian equity indices settled in the green zone with smart gains while the European counterparts too exhibited mixed trends ahead of a second vote for the implementation of the measures scheduled later in the day. In the meantime domestic sentiments also got buoyed by encouraging food inflation numbers which drifted sharply to one and a half month low levels, a week after convalescing over 9% levels. The moderation in inflation numbers came a day after Prime Minister Manmohan Singh said that inflation will come down to 6.5% by March-end if international oil prices soften and commodity prices do not rise further. The numbers indicate that RBI, which has hiked its key interest rate by 2.75% points since March 2010, may not resort to rate resort to further hikes and soften its hawkish stance against inflation.

However, Indian fuel price inflation accelerated to an eight-week high in mid-June and the government's recent move to hike dieseland other fuel prices is expected to put upward pressure on prices in coming weeks and push headline inflation towards double digits. Local sentiments also remained optimistic as FIIs have turned net buyers since Thursday, indicating that interest of foreign funds are not fading any time soon. Back on Dalal Street, the benchmark began the expiry session on an optimistic note and oscillated above the neutral line in a narrow range through most part of the session, lacking any kind of volatility which is typically evident on F&O settlement days. After registering losses in the two previous F&O series, the June series F&O showed a swashbuckling performance adding over four percent from the last series. The NSE's 50-share broadly followed index Nifty, settled close to a percent gains just below the crucial 5,650 support level while Bombay Stock Exchange's Sensitive Index, Sensex amassed over one hundred and fifty points to close below the failed to mirror the performance showcased by their larger peers and important psychological 18,850 level. However, the broader markets negotiated only moderate gains. The midcap index added 0.32% points while the smallcap index rose 0.57% point. On the sectoral front, it was the defensive - FMCG pocket which once again outperformed not only its sectoral peers but also the benchmarks and surged by close to 2%.For the upcoming series 5760-5770 could be the crucial resistance zone where we believe spot index may find some consolidation. Any closing above this level may boost the traders sentiment however 5900-5930 may be the next resistance zone. On the flip side 5500-5530 may provide some important cushions on downside. HAPPY TRADING…….

However, Indian fuel price inflation accelerated to an eight-week high in mid-June and the government's recent move to hike dieseland other fuel prices is expected to put upward pressure on prices in coming weeks and push headline inflation towards double digits. Local sentiments also remained optimistic as FIIs have turned net buyers since Thursday, indicating that interest of foreign funds are not fading any time soon. Back on Dalal Street, the benchmark began the expiry session on an optimistic note and oscillated above the neutral line in a narrow range through most part of the session, lacking any kind of volatility which is typically evident on F&O settlement days. After registering losses in the two previous F&O series, the June series F&O showed a swashbuckling performance adding over four percent from the last series. The NSE's 50-share broadly followed index Nifty, settled close to a percent gains just below the crucial 5,650 support level while Bombay Stock Exchange's Sensitive Index, Sensex amassed over one hundred and fifty points to close below the failed to mirror the performance showcased by their larger peers and important psychological 18,850 level. However, the broader markets negotiated only moderate gains. The midcap index added 0.32% points while the smallcap index rose 0.57% point. On the sectoral front, it was the defensive - FMCG pocket which once again outperformed not only its sectoral peers but also the benchmarks and surged by close to 2%.For the upcoming series 5760-5770 could be the crucial resistance zone where we believe spot index may find some consolidation. Any closing above this level may boost the traders sentiment however 5900-5930 may be the next resistance zone. On the flip side 5500-5530 may provide some important cushions on downside. HAPPY TRADING…….

Saturday, June 4, 2011

FROM THE DESK OF RESEARCH- BY Mansukh June, 2011

Indian equity indices went through a turbulent week as they failed to negotiate a close above the neutral line for even a single session and eventually snapped the week with a cut of over two percent.

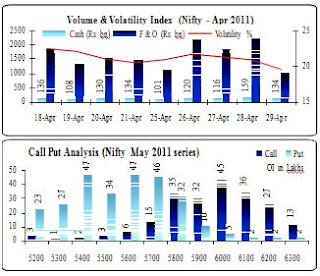

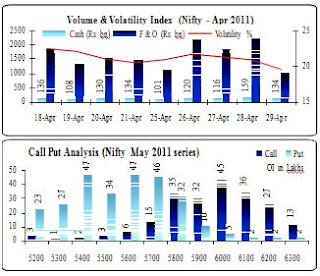

The week largely remained characterized by choppiness because investors were reluctant to pile up positions and indulged largely in stock specific activities as corporate India continued to divulge their fourth quarterly report card. Volatility gradually accelerated session after session as the April series Futures and Options settlement neared while quarterly earnings'announcements by RIL, Wipro, Bank of Baroda, Ambuja Cement, Crompton Greaves, TVS Motors were punished badly as they remained below Street's expectations. On one hand spiraling international crude oil prices become the headache of policymakers while on the other, worries over global economic recovery loomed large, given the fact that world's biggest economy continues to grow at a tepid pace. The April series F&O settlement day turned out to be another pathetic trading session for the Indian stock markets as the selling pressure gathered greater momentum after government released the disappointing food inflation numbers which stayed absolutely flat at 8.76% on annual basis during week-ended April 16 compared with 8.74% recorded in the previous week. Rate sensitive counters like Real Estate and Bankex witnessed relentless selling pressure througsession for theh the week ahead of the RBI's annual monetary policy review meet on May 3rd where it is expected to bite the bullet and hike rates by 50 bps to cool the spiraling inflation which has vehemently hovered at uncomfortable levels on the back of crude oil prices which have skyrocketed by over 50% in last six months. The Foreign Institutional Investors on the other hand ploughed back their money from the local markets to the extent of Rs 2,703 crore in the week on expectations that deteriorating domestic macro headwinds will have adverse impacts on the companies' earnings thereby reducing the returns on investment.

The Foreign Institutional Investors on the other hand ploughed back their money from the local markets to the extent of Rs 2,703 crore in the week on expectations that deteriorating domestic macro headwinds will have adverse impacts on the companies' earnings thereby reducing the returns on investment.

The Bombay Stock Exchange (BSE) Sensex lost 466.27 points or 2.38% to 19,135.96 during the week ended April 29, 2011. The BSE Mid-cap index declined by 141.07 points or 1.95% to 7,094.23 and the Small-cap index shed 163.26 points or 1.84% to 8,715.31. On the sectoral front, Reality lost 201.17 points or 8.45% to 2180.10, Capital Goods (CG) shed 607.16 points or 4.45% to 13,036.91, Bankex declined by 468.163 points or 3.46% to 13545.13, Oil & Gas tumbled by 301 points or 2.92% to 10,008.27 and Metal index down by 467.98 points or 2.81% to 16,190.59,were the top losers on the BSE, while Health Care(HC) adding 74.77 points or 1.21% to 6232.55 and FMCG advanced 24.78 points or 0.66% to 3755.16 were the only gainers on the sectoral space. The S&P CNX Nifty trimmed 135.20 points or 2.30% to 5750. On the National Stock Exchange (NSE), Bank Nifty lost 3.46% to 11,483.75, CNX mid-cap shed 1.36% to 8,200.95, CNX Nifty Junior declined by 1.35% to 11,376.70 and CNX IT tumbled by 0.92% to 6718.35. Conclusively we expect slightly range bound scenario between 5555-5960 though sentiments remain subdued for the upcoming sessions. Any closing above this 5960 with substantial volumes for at least 2 consecutive days may generate another 2-3% return and we might see 6070-6080 in the short term. HAPPY TRADING......

The week largely remained characterized by choppiness because investors were reluctant to pile up positions and indulged largely in stock specific activities as corporate India continued to divulge their fourth quarterly report card. Volatility gradually accelerated session after session as the April series Futures and Options settlement neared while quarterly earnings'announcements by RIL, Wipro, Bank of Baroda, Ambuja Cement, Crompton Greaves, TVS Motors were punished badly as they remained below Street's expectations. On one hand spiraling international crude oil prices become the headache of policymakers while on the other, worries over global economic recovery loomed large, given the fact that world's biggest economy continues to grow at a tepid pace. The April series F&O settlement day turned out to be another pathetic trading session for the Indian stock markets as the selling pressure gathered greater momentum after government released the disappointing food inflation numbers which stayed absolutely flat at 8.76% on annual basis during week-ended April 16 compared with 8.74% recorded in the previous week. Rate sensitive counters like Real Estate and Bankex witnessed relentless selling pressure througsession for theh the week ahead of the RBI's annual monetary policy review meet on May 3rd where it is expected to bite the bullet and hike rates by 50 bps to cool the spiraling inflation which has vehemently hovered at uncomfortable levels on the back of crude oil prices which have skyrocketed by over 50% in last six months.

The Foreign Institutional Investors on the other hand ploughed back their money from the local markets to the extent of Rs 2,703 crore in the week on expectations that deteriorating domestic macro headwinds will have adverse impacts on the companies' earnings thereby reducing the returns on investment.

The Foreign Institutional Investors on the other hand ploughed back their money from the local markets to the extent of Rs 2,703 crore in the week on expectations that deteriorating domestic macro headwinds will have adverse impacts on the companies' earnings thereby reducing the returns on investment.The Bombay Stock Exchange (BSE) Sensex lost 466.27 points or 2.38% to 19,135.96 during the week ended April 29, 2011. The BSE Mid-cap index declined by 141.07 points or 1.95% to 7,094.23 and the Small-cap index shed 163.26 points or 1.84% to 8,715.31. On the sectoral front, Reality lost 201.17 points or 8.45% to 2180.10, Capital Goods (CG) shed 607.16 points or 4.45% to 13,036.91, Bankex declined by 468.163 points or 3.46% to 13545.13, Oil & Gas tumbled by 301 points or 2.92% to 10,008.27 and Metal index down by 467.98 points or 2.81% to 16,190.59,were the top losers on the BSE, while Health Care(HC) adding 74.77 points or 1.21% to 6232.55 and FMCG advanced 24.78 points or 0.66% to 3755.16 were the only gainers on the sectoral space. The S&P CNX Nifty trimmed 135.20 points or 2.30% to 5750. On the National Stock Exchange (NSE), Bank Nifty lost 3.46% to 11,483.75, CNX mid-cap shed 1.36% to 8,200.95, CNX Nifty Junior declined by 1.35% to 11,376.70 and CNX IT tumbled by 0.92% to 6718.35. Conclusively we expect slightly range bound scenario between 5555-5960 though sentiments remain subdued for the upcoming sessions. Any closing above this 5960 with substantial volumes for at least 2 consecutive days may generate another 2-3% return and we might see 6070-6080 in the short term. HAPPY TRADING......

Monday, May 2, 2011

Equity Research Weekly Market Outlook Report By Mansukh 30th-April-2011

SNAPSHOT

Local Bourses prolonged their losses for the fifth straight session lacking support at higher levels, thereby snapping the week with loss of over 2%. Persistent selling pressure in view of sustained capital outflows by foreign institutional investors coupled with selling across the global equities led to the damage at Dalal Street. The 50 scrip index'Nifty --on National Stock Exchange plunged in trade thereby marking sluggish start for the new F&O expiry series on Friday as investors braced for a hawkish statement from the Reserve Bank when it releases its policy on Tuesday. Financials led the decline with the market expecting the Reserve Bank of India (RBI) to raise key short-term rates by at least 25 basis points to rein in high inflation. It would be the ninth increase since mid-March last year. India VIX, a gauge for market's short term expectation of volatility lost 6.40% at 19.58 from its previous close of 20.92 on Thursday. The S&P CNX Nifty lost 34.50 points or 0.60% to settle at 5,750.95. The index touched high and low of 5,804.30 and 5,706.05, respectively. 24 stocks advanced against 26 declining ones on the index.

WEEK GONE BY

Indian equity indices went through a turbulent week as they failed to negotiate a close above the neutral line for even a single session and eventually snapped the week with a cut of over two percent. The week largely remained characterized by choppiness because investors were reluctant to pile up positions and indulged largely in stock specific activities as

corporate India continued to divulge their fourth quarterly report card. Volatility gradually accelerated session after session as the April series Futures and Options settlement neared while quarterly earnings' announcements by RIL, Wipro, Bank of Baroda, Ambuja Cement, Crompton Greaves, TVS Motors were punished badly as they remained below Street's expectations. On one hand spiraling international crude oil prices become the headache of policymakers while on the other, worries over global economic recovery loomed large, given the fact that world's biggest economy continues to grow at a tepid pace. Updates from the 2G case trial kept hitting headlines through the week thereby weighing down sentiments and prompting investors to book profits in scam linked shares like RCom, Unitech and DB Realty. The April series F&O settlement day turned out to be another pathetic trading session for the Indian stock markets as the selling pressure gathered greater momentum after government released the disappointing food inflation numbers which stayed absolutely flat at 8.76% on annual basis during week-ended April 16 compared with 8.74% recorded in the previous week.

corporate India continued to divulge their fourth quarterly report card. Volatility gradually accelerated session after session as the April series Futures and Options settlement neared while quarterly earnings' announcements by RIL, Wipro, Bank of Baroda, Ambuja Cement, Crompton Greaves, TVS Motors were punished badly as they remained below Street's expectations. On one hand spiraling international crude oil prices become the headache of policymakers while on the other, worries over global economic recovery loomed large, given the fact that world's biggest economy continues to grow at a tepid pace. Updates from the 2G case trial kept hitting headlines through the week thereby weighing down sentiments and prompting investors to book profits in scam linked shares like RCom, Unitech and DB Realty. The April series F&O settlement day turned out to be another pathetic trading session for the Indian stock markets as the selling pressure gathered greater momentum after government released the disappointing food inflation numbers which stayed absolutely flat at 8.76% on annual basis during week-ended April 16 compared with 8.74% recorded in the previous week.Related post about Equity Research Weekly Market Outlook Report By Mansukh

Monday, February 14, 2011

MECHANISM OF DERIVATIVES PART-III OPEN INTEREST

After providing the best possible tutorials in our last two sessions on mechanism of derivatives now we will discuss about some more dynamics of derivatives. Derivatives are either used for hedging or for speculation and if you would like to be an active player in the derivatives market than “open interest" is also an important market indicator that could lead you in the right direction. By definition, Open interest refers to the total number of derivative contracts, like futures and options that have not been settled in the immediately previous time period for a specific underlying security. A large open interest indicates more activity and liquidity for the contract. For each buyer of a futures contract there must be a seller. From the time the buyer or seller opens the contract until the counter-party closes it, that contract is considered 'open'.

What is Open Interest?

Every trade in the exchange would have an impact on the open interest for that day. Say, for example, `A' buys one contract of Nifty on Monday while `B' buys two on the same day. Open interest at the end of the day will be three. On Tuesday, while `A' sells his one contract to `C', `B' buys another Nifty contract. The open interest at the end of the day is now four. In other words, if both parties to the trade initiated a new position, it increases the open interest by one contract. But if the traders square off their existing positions, open interest will decrease by the same number of contracts. However, if one of the parties to the transaction squares off his position while the other creates one open interest will remain unchanged. Open interest, thus, mirrors the flow of money into the derivatives market, which makes it a vital indicator of market direction. Here is how you interpret open interest.

Advantage of Monitoring Open Interest

By monitoring the changes in the open interest figures at the end of each trading day, some conclusions about the day's activity can be drawn

Rising Market with Increase in Open Interest

If the markets are on an uptrend and open interest is also increasing, it is a bullish signal. It implies the entry of new players into the market, which are creating fresh long positions and suggests the flow of extra money into the market.

Rising Market with Decrease in Open Interest

If despite a rise in market, the open interest decreases, it can be interpreted as a precursor to a trend reversal. The lack of additions to open interest shows that the markets are rising on the back of short-sellers covering their existing positions. This also implies that money is flowing out of the market, given that open interest is decreasing.

Falling Market with Increase in Open Interest

When open interest records an increase in value amidst a falling market, it could be a bearish signal. Though a rise in open interest means that new trading positions are being created and fresh money is getting routed into the market, the new money is probably being used for creating fresh short positions, which will lead to a further downtrend.

Falling Market with Decrease in Open Interest

If open interest decreases in a falling market, it can be attributed to the forced squaring-off of long-positions by traders. It, thus, represents a trend reversal, since the downtrend in the market is likely to reverse after the long positions have been squared off. Thus, in a falling market, a declining open interest can be considered a signal indicating the strengthening of the market.

Sideways Market with Increase in Open Interest

When the market is range-bound and there is marked rise in the open interest, we can expect a significant movement in the National Stock Exchange and Bombay Stock Exchange. However, the direction of the move cannot be predicted.

Sideways Market with Decrease in Open Interest

If the open interest decreases in a sideways market, we can say that flat market trends will continue for some more time. A decrease in open interest only represents the squaring-off of old positions and lack of any new positions might result in a sideways or weak trends in the market. Though open interest is a good barometer of where the markets are heading; it is only an indicator that helps us trade intelligently; it cannot be considered foolproof.

What is Open Interest?

Every trade in the exchange would have an impact on the open interest for that day. Say, for example, `A' buys one contract of Nifty on Monday while `B' buys two on the same day. Open interest at the end of the day will be three. On Tuesday, while `A' sells his one contract to `C', `B' buys another Nifty contract. The open interest at the end of the day is now four. In other words, if both parties to the trade initiated a new position, it increases the open interest by one contract. But if the traders square off their existing positions, open interest will decrease by the same number of contracts. However, if one of the parties to the transaction squares off his position while the other creates one open interest will remain unchanged. Open interest, thus, mirrors the flow of money into the derivatives market, which makes it a vital indicator of market direction. Here is how you interpret open interest.

Advantage of Monitoring Open Interest

By monitoring the changes in the open interest figures at the end of each trading day, some conclusions about the day's activity can be drawn

Rising Market with Increase in Open Interest

If the markets are on an uptrend and open interest is also increasing, it is a bullish signal. It implies the entry of new players into the market, which are creating fresh long positions and suggests the flow of extra money into the market.

Rising Market with Decrease in Open Interest

If despite a rise in market, the open interest decreases, it can be interpreted as a precursor to a trend reversal. The lack of additions to open interest shows that the markets are rising on the back of short-sellers covering their existing positions. This also implies that money is flowing out of the market, given that open interest is decreasing.

Falling Market with Increase in Open Interest

When open interest records an increase in value amidst a falling market, it could be a bearish signal. Though a rise in open interest means that new trading positions are being created and fresh money is getting routed into the market, the new money is probably being used for creating fresh short positions, which will lead to a further downtrend.

Falling Market with Decrease in Open Interest

If open interest decreases in a falling market, it can be attributed to the forced squaring-off of long-positions by traders. It, thus, represents a trend reversal, since the downtrend in the market is likely to reverse after the long positions have been squared off. Thus, in a falling market, a declining open interest can be considered a signal indicating the strengthening of the market.

Sideways Market with Increase in Open Interest

When the market is range-bound and there is marked rise in the open interest, we can expect a significant movement in the National Stock Exchange and Bombay Stock Exchange. However, the direction of the move cannot be predicted.

Sideways Market with Decrease in Open Interest

If the open interest decreases in a sideways market, we can say that flat market trends will continue for some more time. A decrease in open interest only represents the squaring-off of old positions and lack of any new positions might result in a sideways or weak trends in the market. Though open interest is a good barometer of where the markets are heading; it is only an indicator that helps us trade intelligently; it cannot be considered foolproof.

Subscribe to:

Posts (Atom)